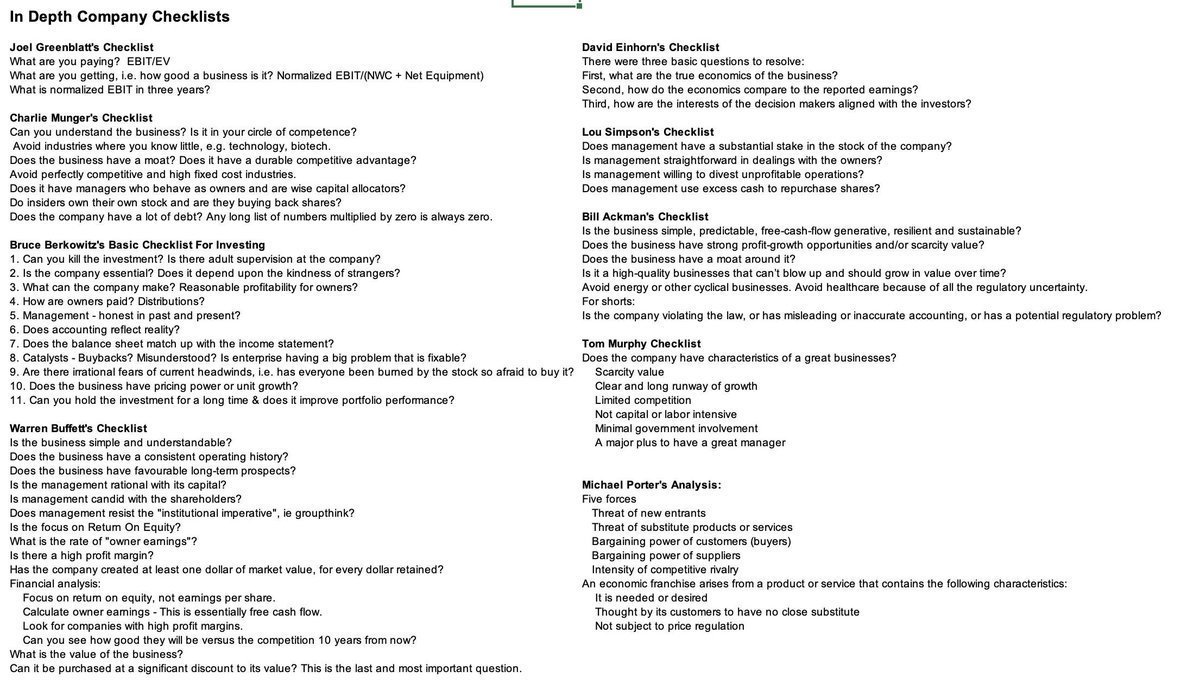

Love this investment checklist that @sb9721p showed me 5 years ago.

Monstrously useful. https://t.co/Hm21YBUSFl

Saved by alex and

Love this investment checklist that @sb9721p showed me 5 years ago. Monstrously useful. https://t.co/Hm21YBUSFl

I’m going to take you through the four most important questions I ask all founders. The goal of asking these questions is not just for you to understand the business but also so you yourself can answer four critical investor questions: Why has this founder chosen this business? How committed is this founder? What are this founder’s chances of succe

... See more