L1 & L2 Token Value Capture - DBA

Currently, even some of the largest protocols are unable to generate enough revenue to cover operational expenses (audits, salaries/payments to contributors, marketing, etc.). Yearn, for instance, operates at a loss even after accounting for non-operating income from yield farming. As such, retaining protocol revenue alone is likely to be insuffici... See more

Yuan Han Li • DAO Treasury/Balance Sheet Management

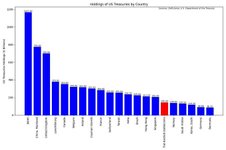

May 2024: Stablecoins are helping create a buyer of second-to-last resort for US Treasurys

writing.kunle.app

The beauty of the work token model is that, absent any speculators, increased usage of the network will cause an increase in the price of the token. As demand for the service grows, more revenue will flow to service providers. Given a fixed supply of tokens, service providers will rationally pay more per token for the right to earn part of a growin... See more

Kyle Samani • New Models for Utility Tokens

With ~10,000 active players, the daily volume on our in-game currency AURUM is ~$600k per day. If we scale up to 100,000 players and that ratio holds, the daily volume would be $6m. If we brought the AURUM/USDC and AURUM/MATIC liquidity into the treasury, that would be $21,000 in revenue per day earned from people trading our in-game currency.