Berkshire Hathaway Letters to Shareholders, 2018

On stocks:Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return— even if you originally buy it at a huge discount. Conversely, if a bus... See more

Charlie Munger • A Lesson On Elementary, Worldly Wisdom As It Relates To Investment Management & Business – Charles Munger, USC Business School, 1994

Also, their discipline of walking away from insurance business when it was badly priced was key to their success.

Business Breakdowns • Berkshire Hathaway: The Incomparable Compounder - [Business Breakdowns, EP. 63]

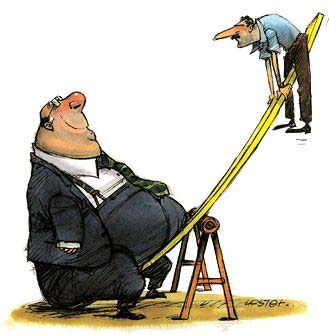

All Revenue Is Not Created Equal: The Keys to the 10X Revenue Club - Above the CrowdAbove the Crowd | by Bill Gurley

economic moatabovethecrowd.com