Sublime

An inspiration engine for ideas

If my return is high, I might be okay having my principal remain in the investment longer because I’m earning a good return on that money. Most of the time, however, I like to get my principal back as quickly as possible because often my equity position would remain the same, even after my initial principal has been repaid.

Justin Donald • The Lifestyle Investor: The 10 Commandments of Cash Flow Investing for Passive Income and Financial Freedom

For me, the ideal scenario is that I get the principal back in one to two years.

Justin Donald • The Lifestyle Investor: The 10 Commandments of Cash Flow Investing for Passive Income and Financial Freedom

Mike Koenigs and Marissa Brassfield:

Justin Donald • The Lifestyle Investor: The 10 Commandments of Cash Flow Investing for Passive Income and Financial Freedom

Mike admitted, “I’m one of those rate chasers, so [with $40,000 in emergency savings] I’ve consistently been earning anywhere between 0.65 and 0.85 percent higher than my operating money market account . . . That’s an extra $300/year in interest, which is definitely worth changing banks every four to six months for me.”

Ramit Sethi • I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

Patrick OShaughnessy @patrick_oshag

twitter.com

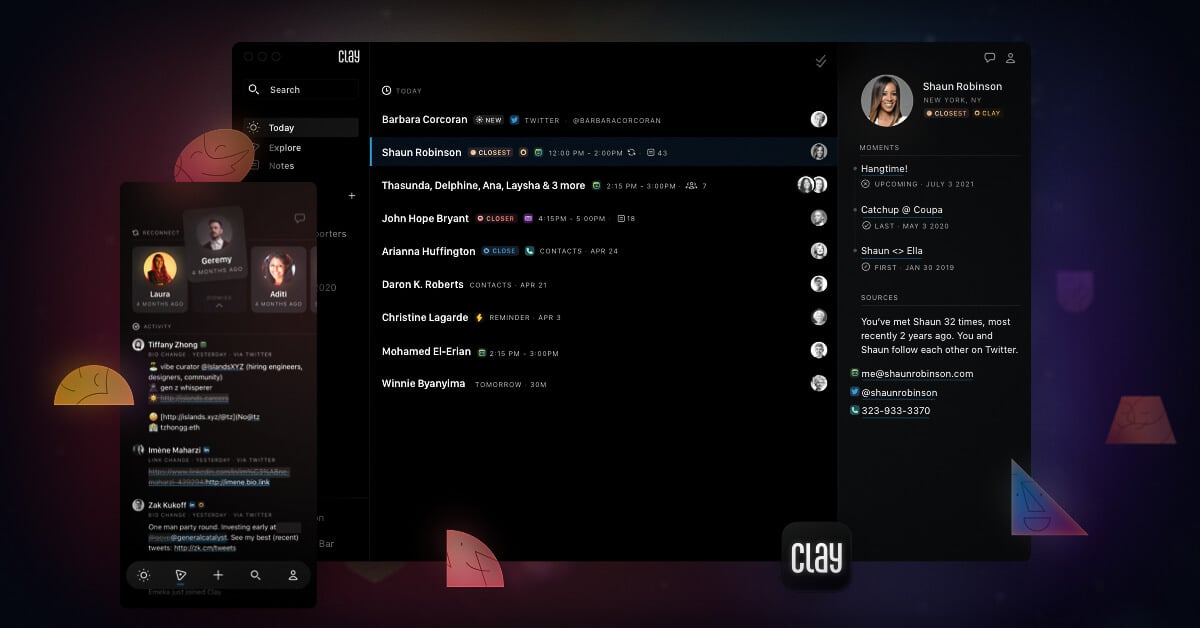

Clay - Be more thoughtful with the people in your network.

clay.earth