Sublime

An inspiration engine for ideas

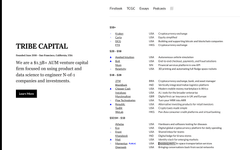

Tribe Capital

tribecap.co

Multicoin may be the highest-returning venture fund of all-time. Firms like Union Square Ventures and Lowercase Capital are legendary for funds with 14x and 76x returns, respectively. Multicoin’s first-ever venture vehicle appears to have them beat.

The Generalist (US) • Multicoin Capital: The Outsiders

Multicoin has its critics, but founders are extremely positive. In the partisan world of crypto, Multicoin’s strident support of its investments can anger dissenters. Loathed by some as a result, the firm is loved by its entrepreneurs. Portfolio founders are exceptionally positive about Multicoin’s contributions.

The Generalist (US) • Multicoin Capital: The Outsiders

Permissionless Capital, Global Consensus and New Markets

zeeprime.capital

A crypto investor active at the time summarized Multicoin’s appeal well: “They were pretty much as smart as everyone else, but their portfolio looked totally different.”

The Generalist (US) • Multicoin Capital: The Outsiders

Multis | Crypto Accounting and Treasury Management

multis.co

The firm has won by taking a contrarian approach. When Multicoin started, the investing landscape was dominated by funds focused on Bitcoin and Ethereum. Founders Kyle Samani and Tushar Jain saw opportunity elsewhere, making contrarian bets on Helium, The Graph, and Solana.