Sublime

An inspiration engine for ideas

All Revenue Is Not Created Equal: The Keys to the 10X Revenue Club - Above the CrowdAbove the Crowd | by Bill Gurley

economic moatabovethecrowd.com

Ben Horowitz on the ideal founding team for a startup

Ben looks for two people on a founding team:

1. The inventor. “It’s the inventor’s job to build a product that’s 10x better than anything that’s available to solve that problem.”

2. The entrepreneur. “The entr... See more

Startup Archivex.comFrom Brian Chesky:

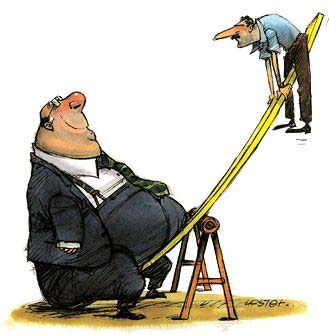

“When you're doing well, investors will give you money on such good terms that it's hard not to take it. But if you do, it will make you slow and bloated.”

On Listening to the Private Markets, Amazon Aggregators & More

Sam Blumenthal • Signal Leverage

Jason Fried Interview: Bootstrapping vs VC, Profit vs Revenue, How to Write, Basecamp, HEY & Once

youtube.comVillage Global's Venture Stories on Apple Podcasts

podcasts.apple.comKagle said to Harvey, “Okay, make him the offer.” Harvey turned to Gurley. “First, I want to know if you’ll take it.” This was the way Harvey preferred to seal a deal with an entrepreneur: to secure the agreement before bringing out the term sheet with all of the details. Here Harvey feared that if he brought out the terms of the partnership offer,

... See moreRandall E. Stross • eBoys: The First Inside Account of Venture Capitalists at Work

I’m famous for having invested $25,000 in Uber when it was worth around $5 million—it’s now worth $70 billion in the private markets. When I invested, Uber was operating in one city and they only had a couple of Lincoln Town Cars signed up. It wasn’t clear if the business could scale or make money, but I knew the founder was exceptionally driven an

... See more